Will Albo’s changes to super affect you?

We’ve broken down the Government’s superannuation changes so you can understand what’s actually happening, what isn’t, and most importantly, how (or if!) it affects your financial future.

In short:

❓ What’s changing? A reduction on tax breaks for super earnings over $3 million.

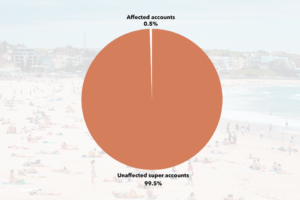

🤷♀️ Who’s affected? Less than 0.5% of super account holders, on earnings above $3 million only.

🗓️ When? From July 1, 2025, applying to future earnings.

➡️ Your next step? All Fox & Hare members are currently unaffected, but your adviser is available for guidance if needed.

Albo’s changed the superannuation rules, but is the panic justified?

So, what’s changing?

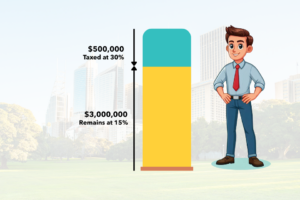

The government is reducing the tax breaks available for those with more than $3,000,000 in their superannuation account. Right now, earnings in super are taxed at a low 15%.

After the 1st July, balances over $3,000,000 will attract a rate of 30%. This reduced tax benefit will only apply to the earnings over $3 million, not your entire balance.

The change is projected to apply to around 80,000 people across Australia – less than 0.5% of all Australians with a superannuation account.

The new rules will only kick in from July 1, 2025.

This policy is not retrospective; it applies only to future earnings. Your existing super balance and past growth will not be re-taxed under the new rules.

The Treasurer’s current intention is not to index the proposed threshold. However, Fox & Hare Co-founder and financial adviser Glen Hare offers his perspective:

“I definitely do not have a crystal ball, I cannot see the future, but looking at government policies and behaviours to date, I would be incredibly surprised if this policy was not adjusted up in future. In 1985 the highest marginal tax rate in Australia was $35,000 today that number is $190,000 – I would be very surprised if future governments did not continue with a similar trend”

This change is projected to affect around 80,000 people across Australia, which is less than 0.5% of all Australians with a superannuation account and 0% of Fox & Hare members.

What the Changes Are NOT

There’s been a lot of discussion (and also quite a bit of hysteria) around the changes and we’ve heard a few very genuine concerns. These are the ones we’ve heard and know to be untrue or misleading:

👥 Concern #1: “The change impacts most everyday Australians.”

Reality: The reform affects a very small fraction of Australians – specifically, the 0.5% with super balances above $3 million. For the vast majority (99.5%), your super tax benefits remain exactly as they are.

To put it in perspective, the average superannuation balance in Australia is around $150,000 and while some argue that many young people will eventually end up with a balance north of $3,000,000 it’s hard to imagine the policy not being adjusted for inflation in the future.

Fox & Hare Financial Advice Co founder, Glen Hare, believes it is unlikely the policy would not be indexed in future.

⏳ Concern 2: “Younger generations will be disproportionately affected by the changes over time.”

Reality: While the $3 million threshold isn’t currently indexed, analyses suggest that even by 2055, only a small percentage (around 5%) of young people working today will reach this threshold – it is likely that a few Fox & Hare members may fall into this category.

Proponents of the bill argue that young people, even those affected, stand to benefit the most as the change aims to improve budget sustainability, potentially reducing future financial burdens on them.

⏪ Concern 3: “It’s a retrospective tax on your existing super balance.”

Reality: The benefit reduction will apply only to earnings generated on balances above $3 million from July 1, 2025, onwards. It does not re-tax any earnings or growth that occurred before this date.

🚫 Concern 4: “The government is putting a cap on how much super you can have.”

Reality: There’s no limit on the total size of your superannuation account balance in the accumulation phase. This change is about adjusting the tax concessions that are available for very large balances, not restricting how much you can save for retirement.

📈 Concern 5: “This will cause people to pull money out of super and inflate the housing market.”

Reality: While individuals will make their own financial decisions, superannuation will still offer a tax-concessional rate on earnings (30% above $3m, 15% below) compared to potentially higher marginal tax rates outside of super.

This means keeping money in super could still be a tax-effective option, even with the change.

In simple terms: in a super balance of $3.5 million, the original 15% tax rate still applies to the earnings from the first $3 million. It’s only the earnings generated by the $500k above the $3 million threshold that are affected.

Will YOU Be Affected by These Changes?

The simple answer: if your superannuation balance is, or is projected to remain, below $3 million, the changes will not affect you.

This change is aimed at the very top tier of superannuation holders with multi-million dollar balances.

For the vast majority of Fox & Hare members, your financial plans and strategies will continue as normal.

Fox & Hare members consistently earn above the average in every state and territory, many earn many multitudes of the average salaries in their state or country of residence (a significant number earn over 10x!) yet not a single member holds a super balance over $3,000,000.

As young professionals on the path to substantial wealth accumulation, understanding how superannuation, tax and other rules might evolve is a smart move. However, you can trust that your adviser is constantly assessing these changes.

If there are proposed changes that are poised to impact your financial future, you can be certain we’ll be actively identifying strategies to ensure you remain in the best possible position.

Please reach out to your adviser via the Personal Finance Portal if you have any further questions.

High-achieving, experienced, and always in your corner. Your Fox & Hare advice team are always working to ensure you are in the best possible possible position – please reach out via the PFP with any questions!

About Fox & Hare:

Fox & Hare are the Millennial, Gen Z and Alpha advisers. We help Australia’s 20-45 year olds buy property, get invested and achieve financial freedom.

When it comes to managing your money, it’s normal to feel uncertain or scared of making the wrong decision. It’s normal to feel so overwhelmed that, despite knowing you need to do something, the first step seems impossible. And it’s also incredibly normal to be earning great coin, but still feeling like you’re behind.

At Fox & Hare we create bespoke, long term financial plans that eliminate these uncertainties. We put you in control of your financial future.

No more option paralysis, fear of missing out or uncertainty about how to manage your money effectively.

If you:

- Want to achieve financial freedom.

- Want the flexibility to live your life on your terms, not tied to a job or working 24/7.

- Want your money to be working for you – not the other way around.

But the idea of learning how and where to start is more than a little daunting, let Fox & Hare do the legwork for you.

Read more insights from our experts

Your First Home, Sooner: A Guide to Albo’s 5% Deposit Scheme

Can the Home Guarantee Scheme Help you Bypass the 20% Deposit? For many Australians, the dream of homeownership quickly turns into a scramble to...

Three Interest Rate Cuts & A Hold: How Does That Affect Your Mortgage?

After years of rate hikes, 2025 has seen 3 interest rate cuts. Plus one confirmed hold and another projected. For most homeowners, that will...

Tax Hacks 2025: Your Tax Return Made Simple

Maximise deductions, minimise stress this tax season. Sure, tax time is not famed for being exciting, or even particularly enjoyable – but your return...

Get Paid What You’re Worth: Your Guide to Getting a Raise in 2025

Ask for a raise, get paid what you’re worth in 2025! In short: This webinar breaks down the essential steps to prepare your case,...

Zac set a goal to save 100k before graduation

Here’s why he’s happy that he ‘failed’. In short: Zac’s goal to save $100,000 before graduation led him to create a “bucket” system for...