At Fox & Hare, the advice over 2025 has been largely consistent:

ignore the noise, trust the plan, and stay the course.

But in a year defined by extreme whiplash – from the sudden panic of ‘Liberation Day’ to a market where just seven companies seemed to drive the entire global rally… it is fair to ask: Why?

To help you understand the method behind the madness, Fox & Hare Community Lead, Liam Hartley, went behind the scenes with Tamas Calderwood, Investment Strategist at Vanguard get the tea on 2025.

Tamas isn’t just a strategist; he is an industry veteran. With an MBA from Columbia University and over 14 years at MSCI (the engine room behind global market indices), he possesses a rare, technical understanding of the “plumbing” of the financial markets.

In this 2025 recap, Tamas walks us through the hard data of the last 12 months to demonstrate exactly how Vanguard manages your portfolio, captures growth, and works to ensure your money is set to weather exactly this kind of storm.

In Short:

🪡 Skip the Needle, Buy the Haystack:

The stats are brutal: over a 20-year period, fewer than 10% of stocks actually beat the index. Tamas explains why trying to pick them is a losing game and how Vanguard ‘win’ against the odds.

🥇 The 2025 Scorecard:

While Tech grabbed the microphone, the quiet achievers stole the show. Gold skyrocketed 44% and Australian Small Caps had a stellar year, up 25%

🔮 The 2026 Outlook: With US valuations looking “stretched,” Tamas predicts that International shares are primed to outperform the US market over the next decade.

Watch the video briefing or read the article below!

Your Next Step:

Read on or watch the webinar recording below, and beat the FOMO by getting the facts. If you want to discuss your next move (or non-move!) with pros, you can reach out to your team directly through the personal finance portal.

Skip the Needle, Buy the Haystack 🪡

2025 continued the trend of massive “missed” opportunities. A small number of assets (like Gold) and equities (like Nvidia) skyrocketed in price – leaving many investors feeling like they had missed the boat.

This strategy – trying to identify and buy specific individual companies yourself in the hope they outperform the rest is what we call “stock picking.”

And we often assume that stock picking is a 50/50 game. You either pick a winner, or you don’t.

That is wrong.

Tamas points to the long-term data on the ASX 300 as an example.

“Over the last 20 years (2004–2024), the Australian share market index went up a massive 361%.” he shares

“But the “median” stock (the company right in the middle of the pack)? It went down 10.7%.”

In plain English, if you tried to pick a winner at random, you’d be statistically more likely to lose money than to simply match the market. In fact, only 8.2% of companies actually outperformed the index over those two decades.

“Basically, to beat the index, you’ve got to choose stocks that are within that 8% of the ASX300 in order to beat the index over time. And statistically, that’s just not that likely.” Says Tamas

The “Skewness” Trap

This is what statisticians call “skewness” – a tiny handful of superstars drive all the returns, while the vast majority of companies do nothing (or go backwards).

In the US, it’s the same story. The S&P 500 rose 616% over 20 years, while the median stock rose just 68%. The massive growth came from a tiny sliver of companies (like Nvidia, Apple, and Tesla).

If you try to find those superstars yourself, you are hunting for a needle in a haystack. The odds are stacked against you.

Tamas’s advice? Stop looking.

“Don’t look for the needle in the haystack, just buy the haystack, because you get the needles. You get all the needles that are in there.

By owning the index (the haystack), you automatically own the winners (the needles) without the risk of betting everything on the losers” He says.

And we saw this exact dynamic playing out globally over 2025, where a tiny group of US Tech giants (the “Mag 7”) drove massive gains, while the rest of the market lagged behind.

It is easy to look back and say “I should have bought Nvidia,” but the stats prove that finding the next Nvidia before it pops is, statistically speaking, close to impossible.

On the other hand, despite the noise and the crazy headlines, if you were invested in, and stayed in the index this year, you didn’t miss out – you captured the growth of those giants automatically, without taking the gamble.

By buying the haystack, you owned the needles!

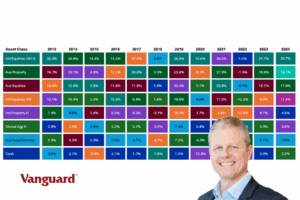

From 2012 to 2024, the “best” investment flipped almost every year. Tamas points to this randomness as the number one argument for diversification: if you own everything, you never miss out on the winner.

2025: The Year of the “Everything Rally” 📈

We wouldn’t blame you for thinking 2025 was about tech, tech and only tech – tech, and AI in particular played an outsize role in the markets this year – but Tech was not the only game in town.

While the “Mag 7” continued to grab headlines, the data shows that 2025 was actually a “Rising Tide” event.

“It’s been a pretty good year across the board,” Tamas confirms.

Even the “boring” stuff made money. Global equities were up 13% and Australian shares rose 12%. If you were diversified (if you “bought the haystack”) – which all Fox & Hare members are, you won almost everywhere you looked.

The “Hype” Was Real

Of course, when markets rally as hard as they have in 2025, it’s inevitable we’re going to see chatter about bubbles and corrections. This is exactly what’s happened toward the end of 2025 as the press have grown jittery about the size of tech stocks and their weight within the market.

But Tamas points out that this time, the growth is backed by cold, hard cash.

“One thing that is driving the valuation of US equities at the moment is profit margins,” he explains. “Profit margins are about 28% above the historical average.”

So, yes, prices are high – but companies are making the money to back up their massive valuations.

🤫 The Quiet Achievers (That Beat the Hype)

It is easy to get tunnel vision when one sector (US Tech) is screaming so loudly. But a healthy portfolio is never just one thing – and 2025 gave us a masterclass in why we spread our bets.

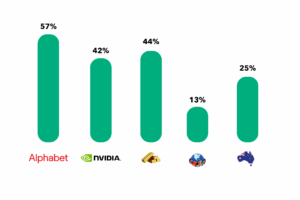

While the “Mag 7” were doing the heavy lifting in the US, they were not the only star performers.

“Gold is a standout performer this year. We all know that story, up 44%,” Tamas notes.

But there was a rally much closer to home that didn’t get anywhere near as much airtime, “Australian Small Caps had a great year, up 25%.” Tamas shares.

These are the companies outside the ASX100 – the innovators and builders that aren’t yet household names and while the big end of town chugged along down under, these smaller companies sprinted ahead, delivering returns that rivalled the best of the US tech sector.

Big tech definitely stole the show in 2025 – but it wasn’t the only show in town. Gold (+44%) and Aussie Small Caps (+25%) quietly delivered massive returns, rewarding those who stayed diversified.

The Crystal Ball: What’s Coming in 2026? 🔮

So, where do we go from here?

If 2025 was the party, Tamas thinks we might need to tamper our expectations for 2026 to “dinner party” – a little quieter, a little more sensible, but still a good time.

He’s is quick to remind us that “the future is incredibly difficult to predict”. However, Vanguard’s data points to three big trends that are potentially coming our way:

1. The “Tall Poppy” Shift

The US has had an incredible run, but valuations are looking “stretched” says Tamas.

Because of this, Vanguard expects the leadership baton to pass along to other markets. “We would therefore expect US shares to underperform international shares over the next few years,” he predicts.

Why? “Simply because international shares don’t have that same valuation… they’ve got a lower PE ratio.” A rough translation into English would be: The US is expensive. The rest of the world is on sale.

2. The Return to Normal (Bonds are Back)

For the last few years, Term Deposits felt like a cheat code – risk-free cash that paid decent interest. But Vanguard are predicting that “weird” window where cash beat bonds is closing. “

We’re heading back into that sort of normal state of affairs now,” says Tamas. “On average, bonds pay more than term deposits. You get paid more for longer term debt.” If you have been hiding out in cash, it might be time to wake your money up.

3. A Little “Tough Love”

Finally, Tamas suggests we start managing our expectations.

We have been spoiled by double-digit growth, but the next decade will likely look different. “The future’s likely not going to be as good as the last 10 years purely because we’ve had a really good decade” he shares.

Vanguard projects Australian equities to return around 5.8% per annum over the next decade. This doesn’t mean the sky is falling. “We think that markets are going to keep trucking along pretty well,” he assures us. Just not that well, apparently.

Missed the live session? No stress. Hit the image to watch the full briefing with Vanguard’s Tamas Calderwood & Fox & Hare Community and Marketing Lead, Liam Hartley.

The Bottom Line

If 2025 taught us anything, it’s that nobody knows what is going to happen next.

Even the professionals with billions of dollars on the line consistently get their predictions wrong. The media might pretend to have a crystal ball, but 2025 proved – once again – that time, patience and diversification are the best bets in the house.

We’ll leave the final word to Tamas:

“The future is incredibly difficult to predict. You just can’t do it… That’s why you have a diversified portfolio. That’s why you buy and hold and stay with your investments over the long term.”

High-achieving, experienced, and always in your corner. Your Fox & Hare advice team are always working to ensure you are in the best possible possible position – please reach out via the PFP with any questions!

About Fox & Hare:

Fox & Hare are the Millennial and Gen Z advisers, 100% focused on helping Australia’s 20-45 year olds buy property, get invested and achieve financial freedom.

When it comes to managing your money, it’s normal to feel uncertain or scared of making the wrong decision; it’s normal to feel so overwhelmed that, despite knowing you need to do something, the first step seems impossible; and it’s also incredibly normal to be earning great coin, but still feeling like you’re behind.

At Fox & Hare we create bespoke, long term financial plans that eliminate these uncertainties and put you in control of your financial future. No more option paralysis. No more fear of missing out. No more uncertainty about how to manage your money effectively.

If you:

- Want to achieve financial freedom.

- Want the flexibility to live your life on your terms, not tied to a job or working 24/7.

- Want your money to be working for you – not the other way around.

But the idea of learning how and where to start is more than a little daunting, let Fox & Hare do the legwork for you.

Read more insights from our experts

A Divorce, a Resignation Letter, and a Boarding Pass: The Art of Starting Over (in NYC🗽)

What do you do when the world falls apart? In short: Facing a divorce, career pivot and global pandemic head on, Danica did what...

No Fomo: A Market Update with Betashares 📉📈

What happened with your portfolio in 2025? It goes without saying this year has been a wild ride. From the re-election of Donald Trump...

Christmas Money: 4 Strategies for 0 Financial Regret this Festive Season.

Last year, Australian shoppers poured $11.8 billion into the holidays. As a result, millions of them walked into January significantly poorer and/or burdened with...

Your First Home, Sooner: A Guide to Albo’s 5% Deposit Scheme

Can the Home Guarantee Scheme Help you Bypass the 20% Deposit? For many Australians, the dream of homeownership quickly turns into a scramble to...

Three Interest Rate Cuts & A Hold: How Does That Affect Your Mortgage?

After years of rate hikes, 2025 has seen 3 interest rate cuts. Plus one confirmed hold and another projected. For most homeowners, that will...