Can the Home Guarantee Scheme Help you Bypass the 20% Deposit?

For many Australians, the dream of homeownership quickly turns into a scramble to solve one huge problem: how exactly do you save the full 20% deposit when houses are SO expensive!?

The Albanese government think they have come up with the solution: updates to the Home Guarantee Scheme (HGS), that allow eligible buyers to enter the market with as a deposit as low as 5%.

We wanted to know more!

So, we partnered with mortgage broker, first home expert, and host of the First Home Unlocked podcast, Jack Elliott, to break down the policy and help you work out if it’s right for you, our amazing Fox & Hare members.

This guide delivers the comprehensive overview you need to assess your eligibility for the program, understand the policy’s pros and cons and determine the next step on your journey to homeownership.

In short:

Lower deposits! 💸:

The Home Guarantee Scheme allows you to buy a home with as little as a 5% deposit while avoiding costly Lenders Mortgage Insurance (LMI).

But only for some ✅:

There are strict rules governing the program, including a property price cap, and you must live in the home (no converting to an investment property while on the scheme).

And best used with caution 💡:

Jack says the HGS should be used as a strategic tool for your long-term goals and vision. Don’t rush into a purchase that might cost you more later.

Watch the video or read the article below!

Your Next Step:

Read on, watch the webinar recording and, if you believe you’d like to access the scheme, reach out to your financial adviser through the personal finance portal. If you’d like to speak with Jack, you can reach him here.

Crushing the 20% Deposit Barrier: The Home Guarantee Scheme Explained 🏡

For decades, if you couldn’t scrape together a 20% deposit, the bank would charge you a significant fee for a product called Lenders Mortgage Insurance (LMI).

LMI is a mandatory insurance policy, paid for by you, that covers the bank, in case you default on your loan. Again, this fee is added to your loan balance – meaning you pay extra interest on the insurance as well as the property – immediately making your home tens of thousands of dollars more expensive.

The Home Guarantee Scheme (HGS) is designed to solve this problem by having the federal government act as your guarantor for up to 15% of the property’s value.

Jack explains:

“If you’re successful in accessing the program and you go to the lender with a 5% deposit, they will now treat you as if you had a 20% deposit. So again, you avoid paying that lender’s mortgage insurance and you get access to competitive interest rates.”

The HGS is NOT a cash grant.

You need to to understand that the HGS is not a cash grant or a lump sum payment from the government towards your deposit. The government is simply stepping in as a guarantor.

This means the government has no ownership or shared ownership in your home. Instead, they are offering their assurances to the bank that the portion of your loan above 80% (up to 95%) is protected, minimising their risk when helping you get into that first home.

The Benefit for You

The benefit for you is twofold:

💰 You avoid paying LMI because the government’s guarantee removes the need for the bank’s own insurance policy.

📈 You get access to competitive interest rates, a benefit typically reserved for those with a full 20% deposit, because the bank is treating your loan as if you met that 20% threshold.

For eligible applicants, this guarantee provides the leverage to enter the market years earlier than otherwise possible, accelerating the start of their property journey.

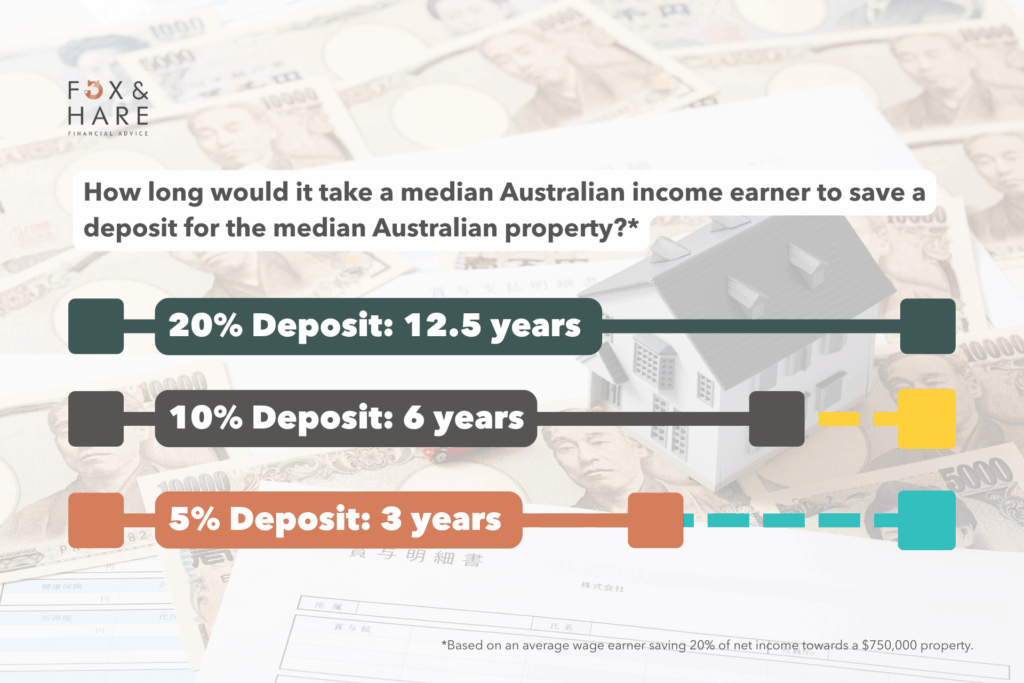

For the average Australian earner, the HGS could make buying possible in a third of the time. This huge time saving would be a direct result of lowering the barrier to entry from 20% down to a minimal 5% deposit.

Eligibility Checklist & Rules ✅

The Home Guarantee Scheme (HGS) has been actively helping first home buyers since 2020, with recent updates removing barriers and increasing its reach from the 1st October 2025.

Understanding these criteria is the first step toward accessing the program.

You must meet the following criteria to be eligible for the HGS:

- Residency:

You must be an Australian Citizen or Permanent Resident and over 18 years old. - Deposit Size:

You must have a minimum 5% deposit (up to 20%) saved. - First Home Buyer Status:

You must be a genuine first home buyer. A key new addition is that you may also be eligible if you haven’t owned a property in the last 10 years. - Income:

They have removed the income caps, meaning your current salary level no longer disqualifies you. - Application Type:

You can apply solo or with one other person (partner, friend, or family member), but both applicants must meet all eligibility criteria. - Property Caps:

The property price must be within the set price caps for your region (these vary by state and territory).

Property Rules: The ‘Live-In’ Restriction

The most crucial restriction to understand is that the scheme is designed to help you secure a home to live in.

Jack explains:

“You can’t just convert it into investment property in a year’s time. The programs targeted specifically at first-time buyers who are looking to move in and live in their property.”

If your financial goals involve buying your first property and immediately renting it out (rentvesting), you won’t be able to do so while the HGS guarantee is in place.

You must live in the property as your Principal Place of Residence until your loan-to-value ratio (LVR) drops to 80% or below.

Application Types: The HGS accommodates individual applications as well as applications by two people. The core constraint remains the same: whether applying solo or as a duo, all stated criteria, such as residency and first home buyer status, must be met by everyone on the application.

How to Get Started: Accessing the Program

The process for accessing the HGS is relatively straightforward:

You can only apply through a participating lender or a mortgage broker.

Jack emphasises the difference between going directly to a single bank versus using a broker:

- Expert Matching:

A good broker compares all available lenders and loan options under the scheme, matching your specific financial profile (e.g., PAYG versus self-employed) to the bank most likely to approve you. - Streamlined Process:

They handle all the eligibility checks, saving you time and preventing emotional attachment to properties that might not meet both the scheme’s and the lender’s individual rules. - No Cost to You:

Working with a broker is often free to the customer, as they are paid by the lender.

When navigating a complex program like the HGS, working with an experienced broker gives you 1-1, professional support and a competitive edge on the path to homeownership.

Layer Your Government Support

You don’t have to choose just one tool—the HGS can be combined with other government support for maximum impact.

- First Home Super Saver Scheme (FHSSS): You can contribute extra funds into your superannuation to save for your deposit and withdraw it later, benefiting from the concessional tax rate. Crucially, FHSSS funds are counted as genuine savings for the HGS.

- State Concessions: You can also typically use your Stamp Duty Concessions and Exemptions alongside the HGS and FHSSS.

Want more of Jack’s expert advice? Click the image to head straight to his First Home Unlocked podcast.

Avoid the Traps: Strategy, Not Shortcuts💡

The Home Guarantee Scheme can help you buy sooner, but it’s not a decision to rush.

Jack cautions that if you’re not grounded in some sort of goal or value, you risk making a “very costly mistake”. Your job is to make sure you’re using the HGS as a strategic tool, not simply a quick fix. “You just want to make sure you’re 100% clear on why you are purchasing that first home, and focusing on your long-term vision is key” he says.

Plan Your Financial Runway (The 5–10 Year Vision)

The biggest financial blunder first-time buyers make is choosing a property that only suits them for a short time. This is why Jack encourages clients to define their ‘financial runway’:

“The longer the runway, the more value or the more growth in equity that you can have… we tend to get our clients to aim for a property that will suit them for the next 5 to 10 years at least.” he says.

What should you consider when thinking about your runway?

Jack describes the runway the period the property is functionally and emotionally right for you. It’s the period that the property will suit your life before you intend or need to sell. Things to consider include, but are not limited to:

💸 Costly Consequences:

If you buy a shotgun property, then need to sell it on after a short period of time, the combined costs of buying, selling, and then buying again can wipe out any initial equity gains you made.

👩❤️👨 The Family Factor: Do you anticipate starting or growing a family in the next 5-10 years, and can this property comfortably accommodate that growth without forcing a premature move?

💼 Career Flexibility: How close is the property to public transport or your place of work? If your career requires a future commute change, will the location still work for you?

🏝️ Lifestyle Non-Negotiables: Will this location still allow you to access the lifestyle you value, whether it’s proximity to restaurants, beaches or being quiet at night?

Don’t Forget the Hidden Costs 💰

Don’t fall into the trap of assuming a 5% deposit will be the final number you need to buy a home. Jack stresses you must budget for all the other unavoidable upfront costs that need to be covered by settlement. Ignoring these expenses is a common reason initial purchase attempts fall through, as the lender won’t approve the final loan until they are covered.

You need to be thinking about:

- Stamp Duty:

This is a major, state-dependent cost. If you’re working with a mortgage broker they can assist you to check for local concessions or exemptions. - Settlement Fees:

Factor in essential costs like lender fees, conveyancing, and inspections. - Cash Buffer is Essential:

Because the HGS maximises your loan-to-value ratio (up to 95%), you have a higher debt and less equity buffer to start with. Jack advises always setting aside a cash buffer for emergencies, as refinancing off the scheme is challenging until your LVR drops to 80%.

This kind of upfront strategic thinking provides a necessary level of clarity, preparedness and helps to minimise risk. Ensuring you are not caught off guard in the event that something pops up or goes wrong.

What’s Next?

You can start by watching the full webinar recording above. If you’re interested in accessing the scheme, you have options: reach out to your preferred lender, contact a participating mortgage broker, or connect directly with our expert, Jack Elliott, for specialised advice. For continued learning, you can also listen to Jack’s First Home Unlocked podcast.

High-achieving, experienced, and always in your corner. Your Fox & Hare advice team are always working to ensure you are in the best possible possible position – please reach out via the PFP with any questions!

About Fox & Hare:

Fox & Hare are the Millennial and Gen Z advisers, 100% focused on helping Australia’s 20-45 year olds buy property, get invested and achieve financial freedom.

When it comes to managing your money, it’s normal to feel uncertain or scared of making the wrong decision; it’s normal to feel so overwhelmed that, despite knowing you need to do something, the first step seems impossible; and it’s also incredibly normal to be earning great coin, but still feeling like you’re behind.

At Fox & Hare we create bespoke, long term financial plans that eliminate these uncertainties and put you in control of your financial future. No more option paralysis. No more fear of missing out. No more uncertainty about how to manage your money effectively.

If you:

- Want to achieve financial freedom.

- Want the flexibility to live your life on your terms, not tied to a job or working 24/7.

- Want your money to be working for you – not the other way around.

But the idea of learning how and where to start is more than a little daunting, let Fox & Hare do the legwork for you.

Read more insights from our experts

A Divorce, a Resignation Letter, and a Boarding Pass: The Art of Starting Over (in NYC🗽)

What do you do when the world falls apart? In short: Facing a divorce, career pivot and global pandemic head on, Danica did what...

No Fomo: A Market Update with Vanguard 📉📈

At Fox & Hare, the advice over 2025 has been largely consistent: ignore the noise, trust the plan, and stay the course. But in...

No Fomo: A Market Update with Betashares 📉📈

What happened with your portfolio in 2025? It goes without saying this year has been a wild ride. From the re-election of Donald Trump...

Christmas Money: 4 Strategies for 0 Financial Regret this Festive Season.

Last year, Australian shoppers poured $11.8 billion into the holidays. As a result, millions of them walked into January significantly poorer and/or burdened with...

Three Interest Rate Cuts & A Hold: How Does That Affect Your Mortgage?

After years of rate hikes, 2025 has seen 3 interest rate cuts. Plus one confirmed hold and another projected. For most homeowners, that will...