After years of rate hikes, 2025 has seen 3 interest rate cuts.

Plus one confirmed hold and another projected. For most homeowners, that will translate into lower minimum mortgage repayments and more cash in the bank.

But with these extra dollars comes a critical question: What should you do with the extra cash?

This article will break down your three main options for turning mortgage relief into future wealth.

In short:

🐨 Australian interest rate cuts may have lowered your minimum mortgage repayments.

🌱 Read this article to ensure you convert any savings into progress towards your long-term goals.

🏆 What matters most isn’t that you’re paying less, but what you do with it.

Your Next Step:

Confirm your new minimum repayment, if you have one! Then, choose your champion – the lowest-risk payoff, or the highest potential return. Read on to find out how.

RBA Governor, Michelle Bullock’s decisions on interest rates are watched by the entire nation. Every meeting of the RBA is a national event because Governor Bullock and the board’s decisions directly determine the size of many Australians’ disposable income.

The RBA & Interest Rates: Your 30 Second Refresher

You can skip this section if you’re an interest rate and Reserve Bank of Australia buff. For everyone else, here’s the quick download.

The Reserve Bank of Australia (RBA) is Australia’s central bank – the bank for the other banks. Its core job is to keep the economy healthy, primarily by managing inflation (keeping it between 2-3%) and ensuring strong employment.

It does this by setting the cash rate, which is the official interest rate at which banks borrow money from each other. Think of the cash rate as the main lever for the whole financial system:

- When the RBA cuts the cash rate:

It costs banks less to borrow, so they typically pass these savings on by lowering rates on things like mortgages. This encourages people to spend and invest.

- When the RBA raises the cash rate:

It costs banks more to lend, so they raise rates for customers. This encourages saving over spending and helps ‘cool down’ the economy.

The interest you pay on your mortgage is simply the fee for borrowing money, and the RBA has a significant, though not absolute, influence over that number.

Fox & Hare Financial Advice’s co-founder and financial adviser, Glen Hare, presents at the Reserve Bank of Australia.

Start Here: Know Your Numbers

The first and most critical action you need to take is an easy one: confirm your current mortgage repayments.

While many major lenders pass on RBA rate cuts, some may only pass on a portion, and others might pass on no savings at all. If you’re going to optimise every dollar at your disposal, you need to know exactly how much you are paying every month.

Grab your phone and calculator, follow the steps below and work out how much of a windfall you are working with.

🏦 Step 1: Confirm Your Rate (and Your Lender’s)

Your first job is to establish your current lowest minimum repayment. Why? Because before you can redirect any savings into one of the strategies ahead, you need to confirm exactly how much “free” cash you actually have.

What to Look For and Where:

Check your email, banking app, or postal mail for official communication. Look closely at your updated statement to see if your interest rate has decreased, or if your lender has changed your monthly minimum.

If you haven’t seen an update, call your mortgage provider directly. You are confirming their decision on your loan to find your number. This is the precise figure we’ll use to lock in your next move.

💡 Step 2: Work Out Your Windfall

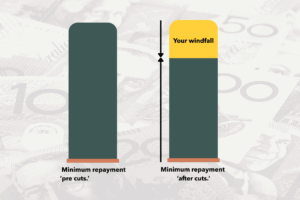

If your minimum repayment has fallen, congratulations – you have unlocked a monthly windfall!

Your provider will probably provide you with an overview of your change in payment, however, if they don’t/haven’t, you can work our your windfall by using this easy calculator we prepared with our friends over at Alcove Mortgage Brokers.

To use it, you’ll need to know:

- Your loan amount

- Loan term

- Current interest rate &

- The interest rate reduction you’re working with

This calculated figure is the newly liberated cash that is now available to put to work.

The difference between your old repayments and your new minimum is your monthly “free” cash. That monthly drop would mean a windfall is now yours to command. Don’t let it go to waste! Tap the image to access our windfall calculator.

Your Options

Option 1: Pay down the mortgage

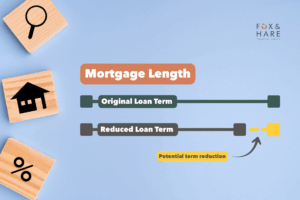

The safe bet. This is the most direct and lowest-risk approach: simply maintain your old, higher repayment rate. By continuing to pay your mortgage as if the rate cut never happened, you pay down your debt faster, accelerating your journey to being mortgage-free.

Pros ✅

- Guaranteed, Risk-Free Return:

Every dollar you put toward your principal is a dollar you don’t pay in interest. This saving is a guaranteed, non-taxable “return” equivalent to your mortgage rate—a certainty that’s hard to beat in a volatile market.

- Massive Interest Savings:

By increasing your repayments, you can shave years off your loan term and save tens of thousands of dollars in interest over the life of the loan. For example, maintaining your old repayment amount on a large loan can save nearly $100,000 in interest and help you become mortgage-free years earlier.

- Peace of Mind:

For many, the emotional benefit of owning your home sooner is huge. A smaller mortgage means less financial stress and a feeling of greater security and control.

Cons ❌

- Less Liquidity: Money tied up in your home’s principal is difficult to access quickly, as you can’t sell a spare room

- Lower Potential Return: You cap your ‘return’ at the interest rate of your mortgage, potentially missing out on higher, long-term market returns.

Accelerating your mortgage is a guaranteed, risk-free win for peace of mind and interest savings. But, the guaranteed return is capped at your current mortgage rate. It’s the lowest-risk approach, but also misses out on the potential for higher long-term growth.

Option 2: Grow your portfolio

A calculated bet! Instead of putting extra money into your home, you could redirect it into building other assets. This path is often chosen by those comfortable taking on more risk in pursuit of potentially higher long-term returns.

Pros ✅

- The Opportunity for Higher Returns:

A diversified investment portfolio (shares, ETFs, superannuation) could, over the long term, potentially generate a higher average return than your mortgage interest rate.

- Diversification and Liquidity:

By investing outside of your home, you diversify your wealth and spread your risk, ensuring not all your eggs are in one illiquid basket (you can’t sell a spare bedroom, but you can sell shares). You can also often access these funds more quickly in an emergency.

- Tax Advantage:

Directing funds into investments like superannuation offers significant tax advantages and can reduce your taxable income.

Cons ❌

- Market Risk:

Investment returns are not guaranteed and the value of your assets can fluctuate in the short term.

- Timeframe to access funds:

To manage short term fluctuations, you should ideally not intend to access any invested funds for at least 5-7 years.

An age old battle, property vs shares: paying down your mortgage means locking your extra cash behind a single, illiquid door. Investing means opening the gates to a diversified portfolio where your money could access tax advantages and seek a potentially higher return than your mortgage rate

Option 3: Spent it, girl! YESSSSS 💅🏼

The path of least resistance! Simply allow the cash windfall to disappear into your daily consumption. This is the default path many unconsciously follow.

Pros ✅

- Instant Gratification:

immediate increase in your disposable means more dining out, shopping, or travel.

- Zero Effort:

Requires no conscious financial decision, saving you the mental work of putting the money to work (in the short term)

Cons ❌

- Most Costly Long-Term:

You forgo the power of compounding interest and permanently sacrifice years of potential growth.

- Erodes Financial Control:

This passive spending increases your baseline consumption, making it harder to pull back later.

- Zero Impact on goals:

The money is spent and disappears with zero impact on your long-term goals.

Instant Cash, Zero Effort, Zero Impact on Goals. This is the default path many unconsciously follow. You save the mental work, but spend your future potential. Don’t let your windfall vanish without a trace – especially not on things you forget a week later.

Seize the Momentum: Your Next Move

A reduced minimum payment is an opportunity. The key is to capture that cash as early as possible and consciously direct it, rather than letting it leak into your everyday spending and disappear.

The worst possible outcome in this scenario is to let the extra income just disappear.

When money arrives unexpectedly – whether it’s an inheritance, a tax refund, or a cut to your mortgage repayment – it is often perceived as “less valuable” than earned income, making it easier to spend mindlessly on splurges and unplanned purchases.

The good news is…

You’re not alone! As a Fox & Hare member, you already have a distinct advantage: you have a comprehensive plan in place and a team on hand to help you adjust it. You don’t need to start from scratch.

Once you’ve worked out whether you do have extra cash to play with, and you have considered the options presented above, just reach out to your Associate via the PFP and let them know what you’re thinking.

You’ve set goals with your advice team for a reason.

They know your situation personally and have the technical knowledge to map out the optimal next step, whether that’s increasing your mortgage payments or directing the funds somewhere else.

We are here to ensure every dollar you earn and save is working tirelessly to bring you closer to your ideal life.

Don’t let a valuable opportunity pass you by!

High-achieving, experienced, and always in your corner. Your Fox & Hare advice team are always working to ensure you are in the best possible possible position – please reach out via the PFP with any questions!

About Fox & Hare:

Fox & Hare are the Millennial and Gen Z advisers, 100% focused on helping Australia’s 20-45 year olds buy property, get invested and achieve financial freedom.

When it comes to managing your money, it’s normal to feel uncertain or scared of making the wrong decision; it’s normal to feel so overwhelmed that, despite knowing you need to do something, the first step seems impossible; and it’s also incredibly normal to be earning great coin, but still feeling like you’re behind.

At Fox & Hare we create bespoke, long term financial plans that eliminate these uncertainties and put you in control of your financial future. No more option paralysis. No more fear of missing out. No more uncertainty about how to manage your money effectively.

If you:

- Want to achieve financial freedom.

- Want the flexibility to live your life on your terms, not tied to a job or working 24/7.

- Want your money to be working for you – not the other way around.

But the idea of learning how and where to start is more than a little daunting, let Fox & Hare do the legwork for you.

Read more insights from our experts

Christmas Money: 4 Strategies for 0 Financial Regret this Festive Season.

Last year, Australian shoppers poured $11.8 billion into the holidays. As a result, millions of them walked into January significantly poorer and/or burdened with...

Your First Home, Sooner: A Guide to Albo’s 5% Deposit Scheme

Can the Home Guarantee Scheme Help you Bypass the 20% Deposit? For many Australians, the dream of homeownership quickly turns into a scramble to...

Tax Hacks 2025: Your Tax Return Made Simple

Maximise deductions, minimise stress this tax season. Sure, tax time is not famed for being exciting, or even particularly enjoyable – but your return...

Get Paid What You’re Worth: Your Guide to Getting a Raise in 2025

Ask for a raise, get paid what you’re worth in 2025! In short: This webinar breaks down the essential steps to prepare your case,...

Your Super: What the New $3 Million Tax Changes Mean for You

Will Albo’s changes to super affect you? We’ve broken down the Government’s superannuation changes so you can understand what’s actually happening, what isn’t, and...