Here’s why he’s happy that he ‘failed’.

In short:

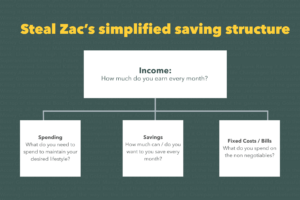

Zac’s goal to save $100,000 before graduation led him to create a “bucket” system for managing the $750 he was earning each week at his part time job. By pre-allocating and dividing funds into categories like essentials, lifestyle, and savings he was able to save vast sums of money in a very short period of time.

Chasing $100k.

“There was no math behind the target at all,” Zac admits with a shrug. “100k is just a nice big target and I don’t think anybody could say that saving that amount isn’t a milestone.”

Four years later, he graduated with just over $95,000 across savings and investments.

“I missed my target,” he reflects, “but I am not bothered by that at all. I am actually happy because, first, I know that I definitely could have hit the goal and, second, because I learned a really important lesson.”

Saving 95k is an exceptional achievement for any Australian, which makes the feat even more impressive for a student juggling work and a full-time study load. So, how did Zac do it? And why did he ‘give up’ so close to his goal – making a conscious decision to miss his target?

It’s easy to jump to assumptions like ‘nepo baby’, elite private school or ultra wealthy family when we hear about young people’s financial success, but those assumptions underplay and undervalue the hard work of people like Zac – and many like him.

He earned a scholarship by excelling at a state school on Brisbane’s northside, self funded his volleyball training and participation for fun and worked casually in student services at his alma mater, QUT, bringing in a steady $1500 per fortnight. Not a life of excess or relying on billionaire parents.

“I kept hearing people say things like ‘everything gets easier after the first 100k’, ‘you’ll have a nest egg’, and ‘it’s going to start compounding’, all that type of thing.

So, even though I wasn’t earning that much, I set myself the goal to save $100,000 before graduation.”

It was an ambitious goal, particularly for a student. But Zac wanted to set a challenging target and see if he could hit it.

Zac didn’t have a specific goal in mind when he himself a $100,000 savings goal – ‘it was just a nice big target’ he says. His success proves that big financial milestones are achievable with drive, not just high income.

Buckets: Zac’s blueprint for financial control.

Zac’s path to saving wasn’t paved with complex investment strategies or extreme frugality. Instead, it was built on a simple, effective system: buckets.

He took his fortnightly income ($1500) and consciously divided it into three separate categories:

- Essentials:

Covering the non-negotiables for life, including transport, textbooks, study materials, and contributions to the household.

- Lifestyle:

Allocating funds for socialising with friends and his girlfriend, enjoying meals out, pursuing hobbies, and staying up-to-date with his wardrobe.

- Savings:

The dedicated “100k” bucket, designed to grow steadily with each paycheck.

To make the system foolproof, Zac took a practical approach.

He set up three separate bank accounts, one for each category, and he automated transfers that would distribute the funds to their allocated account on payday. This meant his money was automatically sorted, reducing the temptation to overspend from his savings.

This system provided Zac with:

- Clarity:

He always knew exactly how much money he had available in each category.

- Control:

He made conscious choices about his spending, rather than reacting to impulses.

- Flexibility:

He could adjust his lifestyle spending if needed to prioritise his savings goal.

But less than six months out from graduation and well within striking distance of his $100,000 goal, Zac’s commitment to saving was put to the test when he was presented with an opportunity to study abroad in Seoul.

Zac’s secret weapon to saving big wasn’t complex; it was a simple ‘bucket’ system, customised to his situation for clarity and control.

Korea calling: when opportunity knocks 🇰🇷

“I’d almost made it to $95,000 – with six months left to go – when an opportunity to go live and study in South Korea for a month came up.

The cost was around $6000 and I jumped. I definitely was NOT expecting to go to Korea, let alone study there, but it sounded like a great opportunity, so I dipped into my savings and paid for the whole thing myself!

For many students – and even adults – an out of the blue $6000 price tag would mean an automatic no. But Zac had options. His “100k” bucket, filled by his earlier planning and consistent saving, presented him with the opportunity of a lifetime.

He could stick rigidly to his goal, or he could embrace an experience that might not come again.

“I had to look at the opportunity in front of me and ask, ‘where do I draw the line?’” Zac recalls.

“This was a once in a lifetime opportunity! And while hitting my goal was definitely important, I think what’s more important is having the flexibility and resources to enjoy my life”.

Ultimately, Zac chose the experience. “It was amazing.” he says.

“It was snowing every second day. I spent New Year’s Eve in Seoul with this group of other students from all around the world! We ate ramen, we went to this floating 7-eleven and had drinks while all the fireworks went off around us. It really was an amazing experience.”

Six months later, after his trip to Seoul, Zac graduated with just over $95,000 in savings and investments.

He didn’t quite reach his initial $100,000 goal, but he gained something far more valuable than a rounded number in the bank.

The real lesson of Zac’s savings ‘fail’? It’s the flexibility to choose experiences that truly matters. The numbers in the bank are the means – not the end.

The $95,000 perspective: it’s about more than just money.

“I didn’t hit my target. But if I’m honest I’m not bothered by that at all. How could I be?” Zac says. “It’s true that I definitely COULD have made it to the $100,000, but that would have meant missing out when a once in a lifetime opportunity came my way.

I’m still young, I value experiences and even though money will always be super important I learned that when I manage my money properly, I can afford to put a premium on living my life!”

Zac’s experiences reveal the often-missed elephant in the room – that financial discipline isn’t about going without. It’s about laying the groundwork that allows you to choose your own adventure and live a meaningful life – whatever that might mean to you.

His story offers a refreshing, practical perspective on personal finance, particularly for young Australians:

- Start early, even small:

Consistent saving, even on a modest income, creates a financial buffer and opens doors to unexpected possibilities.

- Set goals, but stay flexible:

A target provides direction and motivation, but life is unpredictable. Be willing to adjust your plans and priorities as you go.

- Value experiences over pure accumulation:

Money is a tool to enhance your life, not the sole purpose of it. Don’t let the pursuit of savings overshadow the joy of living.

- Automate, automate, automate:

Set up separate accounts for essentials, lifestyle, and savings, automating transfers to each on payday. ‘Set and forget’ your finances to minimise both temptation and friction and stay committed to your goals.

The often missed elephant in the room: financial discipline isn’t about going without. It’s about laying the groundwork to choose your own adventure and live a meaningful life – whatever that might mean to you.

Fox & Hare can help.

Zac understands firsthand how crucial a solid financial plan is for unlocking big life moments – and spends his days helping Fox & Hare members achieve that same level of clarity and control.

If you ready to take the next steps toward the life you aspire to, reach out to Fox & Hare for a free virtual coffee catch up.

We have helped hundreds of 20-45 year olds unlock their potential and find the freedom, security and stability they deserve.

We can assess your current financial world – and give you 100% clarity on how to:

- Pay down debts

- Save to buy a home

- Quit work for a career change / start a business

- Achieve financial freedom

With clear, reliable and realistic time frames.

If you want to be debt free? We can tell you exactly how long that will take. If you want to own a home? We can tell you how long that’ll take too. Want to start a family? We can tell you down to the day.

So, if you want to put an end to that feeling of unease “when will I be able to buy a home?” “when will I be debt free?” “will I ever feel financially secure?” Hit “Book now!” and claim your free virtual coffee with our Member Success Manager, Will today.

Book now!

About Fox & Hare:

The company was Founded in 2017 by two former Macquarie execs. Fox & Hare aims to empower and educate Australians in the wealth accumulation phase of their life journey. Through the provision of a safe, inclusive and accepting environment, they’ve built a diverse and devoted following of 20- 40 somethings. Members come from many backgrounds, abilities and genders. The organisation and its co-founders have featured in the AFR, Equity Mates and Sydney Morning Herald. They have been included in Financial Standard’s Power 50 and Glen Hare was voted Australia’s best Financial Adviser for 2024.

Read more insights from our experts

Get Paid What You’re Worth: Your Guide to Getting a Raise in 2025

Ask for a raise, get paid what you’re worth in 2025! In short: This webinar breaks down the essential steps to prepare your case,...

Your Super: What the New $3 Million Tax Changes Mean for You

Will Albo’s changes to super affect you? We’ve broken down the Government’s superannuation changes so you can understand what’s actually happening, what isn’t, and...

Get Hired in 2025: How to Stand Out and Land Your Dream Job

Upgrade Your Career and Earn More Money in 2025! In short: This guide breaks down the essential steps to get hired and boost your...

“I’m a Foster Mother to 8 Children”

In a nutshell: Nanay (mother) Butch is one of twelve foster mothers at SOS Children’s Village, Cebu. Together they provide loving homes to 116...

🍖 BBQ Bites: Tariffs

Tariff. A beautiful word. We’re 37 days into the new American administration and it’s been a doozy. The headlines are flowing so thick and...